Wall Street narratives can change relatively quickly as investors translate new information into speculation over future events. One of the widely publicized narratives at the beginning of the year was the ‘Goldilocks’ economy. This theme was used to describe an ideal economic state, where inflation is not too hot and growth is not too cold, analogous to the porridge that was “just right” in the popular Goldilocks and the Three Bears children’s story. Stocks tend to do well against this backdrop, evidenced by the S&P 500’s 10.2% price gain in the first quarter — a rally that also included 22 record highs and a maximum drawdown of only 1.7%.On Main Street, narratives often change with the seasons. I was reminded of this when watching snowfall quickly turn into rain during a volatile week of weather in the Midwest. Inevitably, as the narrative goes, April showers bring May flowers, at least that is the hope. With markets, hotter-than-expected inflation data underpinned a volatile few weeks of price action and delivered the proverbial April showers, driving the S&P 500 down 5.5% this month, as of April 19.Akin to spring, there is also hope for May flowers blooming in the form of a market rebound.…

In our latest Capital Planning Spotlight, we spoke with our newest intern, Matt Tuley.What did we learn? Well Matt has a great book recommendation, a go-to sport, and was drawn to one specific subject in school.Read on to find out more!What’s the best book you’ve read recently? I recently enjoyed reading A Random Walk Down Wall Street, by Burton G. Malkiel. This is a wonderful introductory book on stock markets and makes many investing concepts easier to understand.Do you have any hidden talents or hobbies? I enjoy spending my free time on the golf course. I had the pleasure of spending two summers working at a golf course during college. I love the competition and free-mindedness while being on the course.What was your favorite subject in school?My favorite subject in school was Mathematics. I have enjoyed working with numbers from a young age and this ultimately led to myself seeking a job in Finance.

Let's take a look at the latest news with the economy, highlighted by several bright spots.Strong Job Momentum Has SurprisedIn the latest employment report, the Bureau of Labor Statistics (BLS) issued revisions to the prior 12 months, and it turns out that firms added more jobs in 2023 than originally reported. As last year ended, investors thought businesses added 2.7 million jobs, but after revisions, businesses added roughly 3.1 million.Job Growth Healthier Than Originally ReportedThe stronger employment figures tell us that businesses and households have stronger momentum going into 2024, and therefore, we believe it is prudent to increase our forecasts for economic growth. Headwinds remain but on an annual basis, we believe the U.S. and global economy is poised for a bit stronger growth this year than originally forecasted last year.It’s More Than Just JobsAnother factor that suggests the economy could move through this year with fewer headaches is the improving credit conditions. The latest Senior Loan Officer Survey tells us credit supply and credit demand are getting into better balance. Financial conditions improved in recent months as fewer banks tightened credit conditions in Q4 because fewer firms were pessimistic about demand. As investors digest the experience of loan…

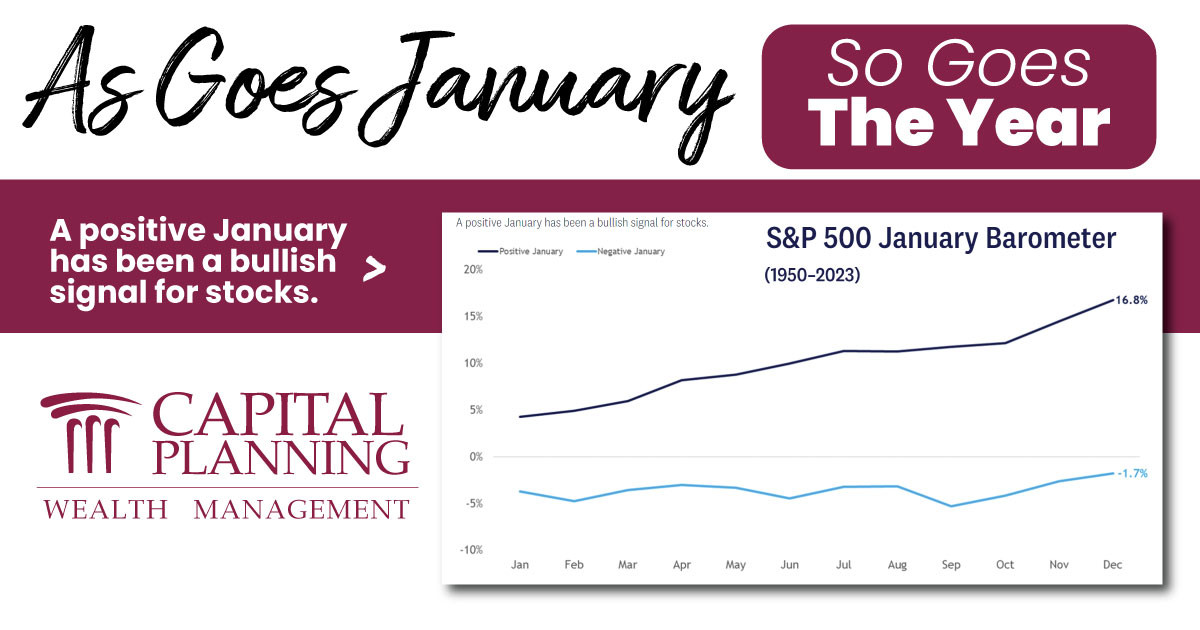

After a relatively slow start, the S&P 500 rallied during the back half of January and closed out the month with a gain of 1.6%. Buying pressure was relatively narrow, as declining shares on the index modestly outpaced advancers. Similar to 2023, a few mega-caps did most of the heavy lifting. Shares of NVIDIA (NVDA), Microsoft (MSFT), and Meta (META) contributed 80% of the S&P 500’s total return during the month.From a historical perspective, a positive January has been a bullish sign for stocks. Yale Hirsch, creator of the Stock Trader’s Almanac, first discovered this seasonal pattern back in 1972, which he called the January Barometer and coined its popular tagline of ‘As goes January, so goes this year.’As highlighted in the chart below, the popular Wall Street maxim has stood the test of time. Since 1950, the S&P 500 has posted an average annual return of 16.8% during years that included a positive January. Furthermore, the index generated positive returns during these years 89% of the time. In contrast, when the index traded lower in January, annual returns dropped to -1.7%, with only 50% of occurrences yielding positive results.S&P 500 January Barometer (1950–2023)Source: LPL Research, Bloomberg 02/01/24Disclosures: Past performance…

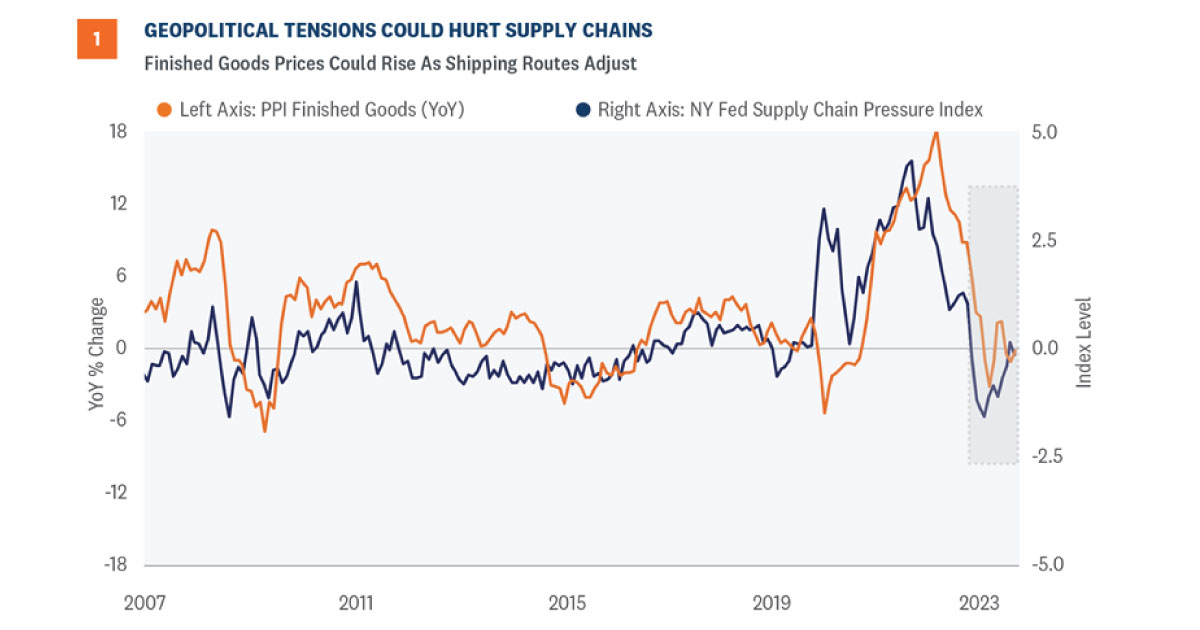

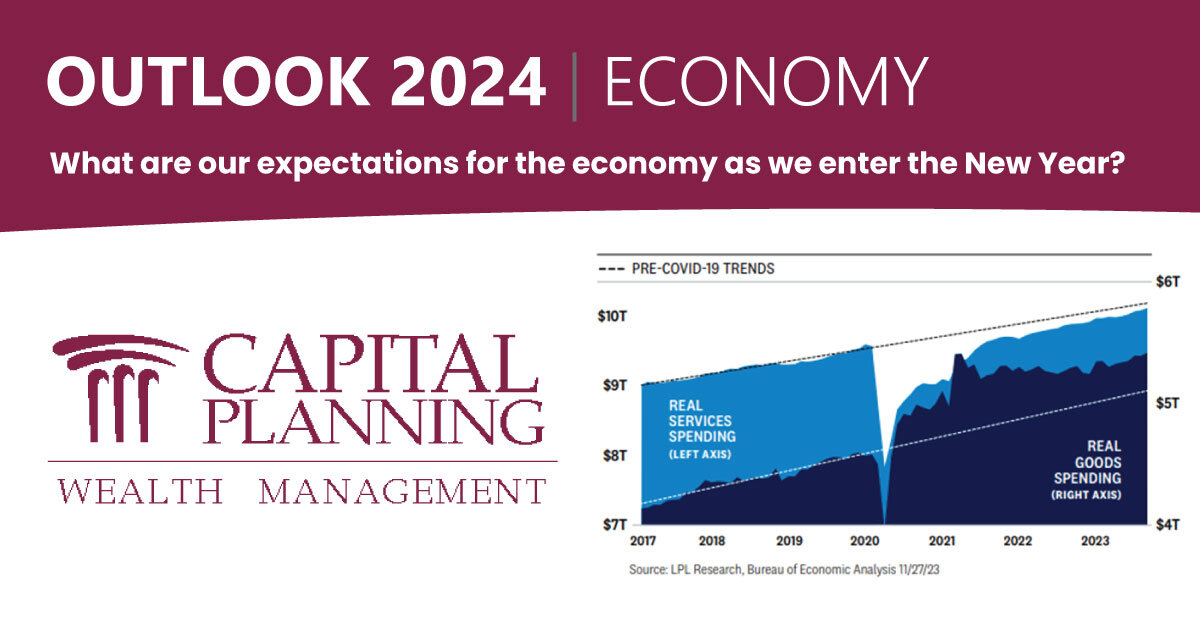

Shipping disruptions in the Red Sea could temporarily impact goods prices but not at the same magnitude as during the pandemic. Tight financial conditions, slowing economic growth, and a disinflationary trend all support the Federal Reserve’s (Fed) pivot away from tightening monetary policy to easing in the new year. Despite these longer term trends, rates possibly got ahead of themselves in recent weeks, exhibiting higher volatility.Supply Chain Shocks Not the Same Magnitude as Pandemic OnesThe global economy experienced multiple shocks in recent times from the Russian attacks on Ukraine, atrocities in the Middle East, the seating of an unconventional president in Argentina, and most recently, a crisis in the Red Sea. Yet, markets and the economy remain surprisingly resilient. Could the recent challenges in inter-continental shipping contribute to a resurgence of inflation and hamper the Fed’s plans this year?During the depth of the pandemic, shipping lanes backed up due to understaffed ports and insufficient supply of intermodal containers. Additionally, activity at production plants was hampered from governmental restraints and inconsistent labor supply. Investors often overlook the length of time for the backlogs to clear — ports didn’t return to more normal levels until the middle of 2022.1 The lack of supply…

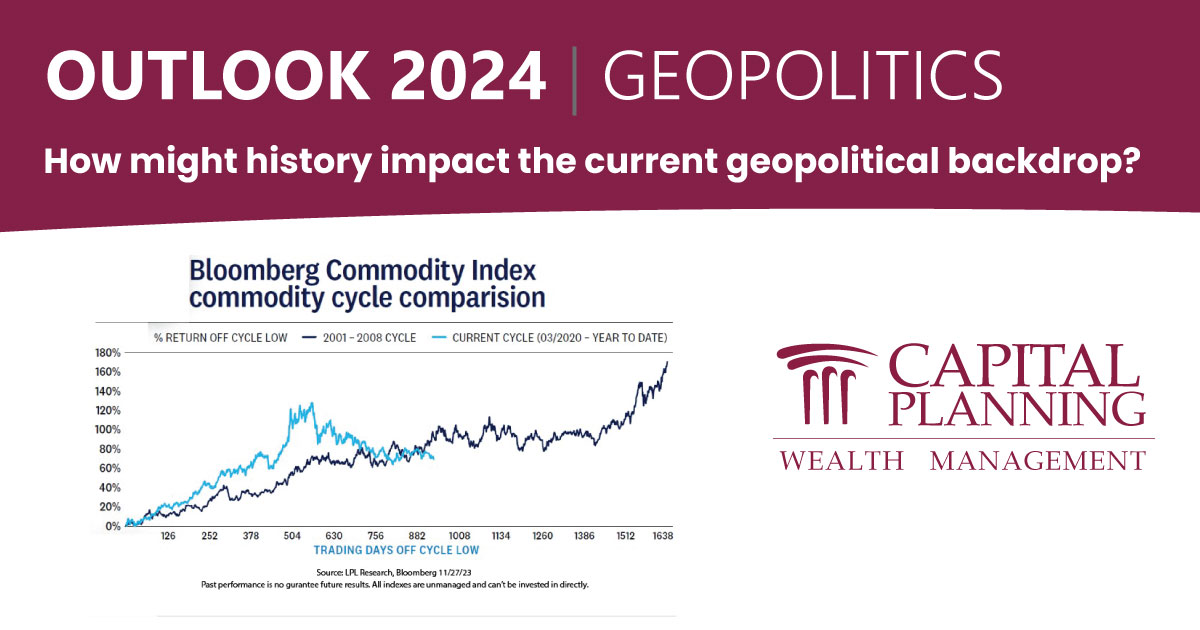

We can’t look back in history without seeing eras marked by war and conflict. With the onset of the war in the Middle East, geopolitical concerns have broadened from the ongoing Russia/Ukraine conflict and implications for a wider confrontation along the NATO border. The recent military threat imposed by Hamas has also brought the Middle East back into the spotlight, with questions around how long the Israeli/Hamas conflict will last. From an investment standpoint, any geopolitical tension has the potential to affect the markets. There’s also an impact on commodities, meaning we’ll want to keep a closer eye on those asset classes producing goods in these regions of conflict.Despite rising tensions and uncertainty across the globe, investors should keep a long-term orientation and favor a well-diversified portfolio. We believe that diversification across sectors, regions, and asset classes can help investors hedge against and make the most of volatile markets.TECHNOLOGY’S ROLE IN U.S.-CHINA RELATIONSDespite attempts to foster deeper commercial ties, the U.S. has two goals dominating its relations with China. The first goal is keeping China from acquiring advanced semiconductor technology that can be applied to its expanding military buildup. The second is establishing a U.S. domestic semiconductor supply chain infrastructure. Protectionism,…

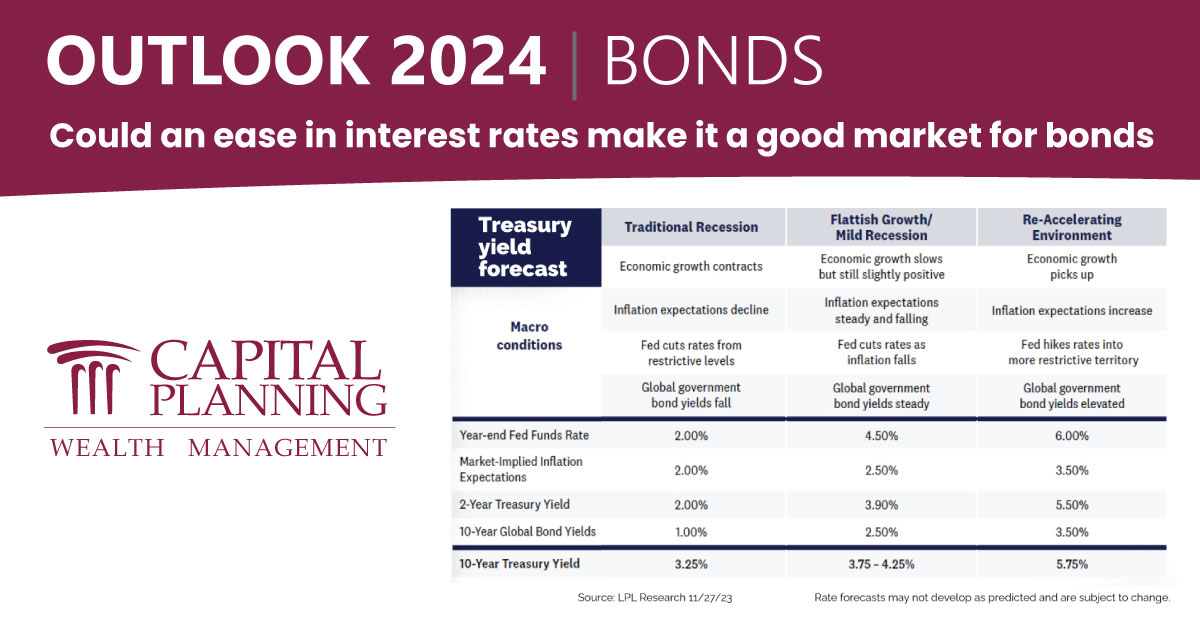

For the first time in over 10 years, we’re seeing new growth opportunities in the fixed-income market. Some might say the turning point for bonds is a return to normal, one where investors can expect decent returns without the risk that comes with stocks. This is a key reason we believe investors can feel confident about bonds for 2024.RATES LEAD THE WAY U.S. Treasury yields moved higher in 2023 with the interest rate on the 30-year Treasury bond briefly trading above 5% for the first time since 2007. The steady increase in interest rates (which makes bond prices go down) hit the intermediate and longer-term Treasury bonds the hardest. There are several reasons we saw higher yields, but rates moved higher alongside a U.S. economy that continued to outperform expectations. As the U.S. economy continued to perform better than expected, interest rates went up, and the chances for a recession went down, which in turn led the Fed to stick to its “higher for longer” approach—rather than lowering rates to stave off a looming recession.As the economy has continued to be better than expected, we have witnessed some spikes in Treasury bond yields. While we think the 10-year Treasury yield…

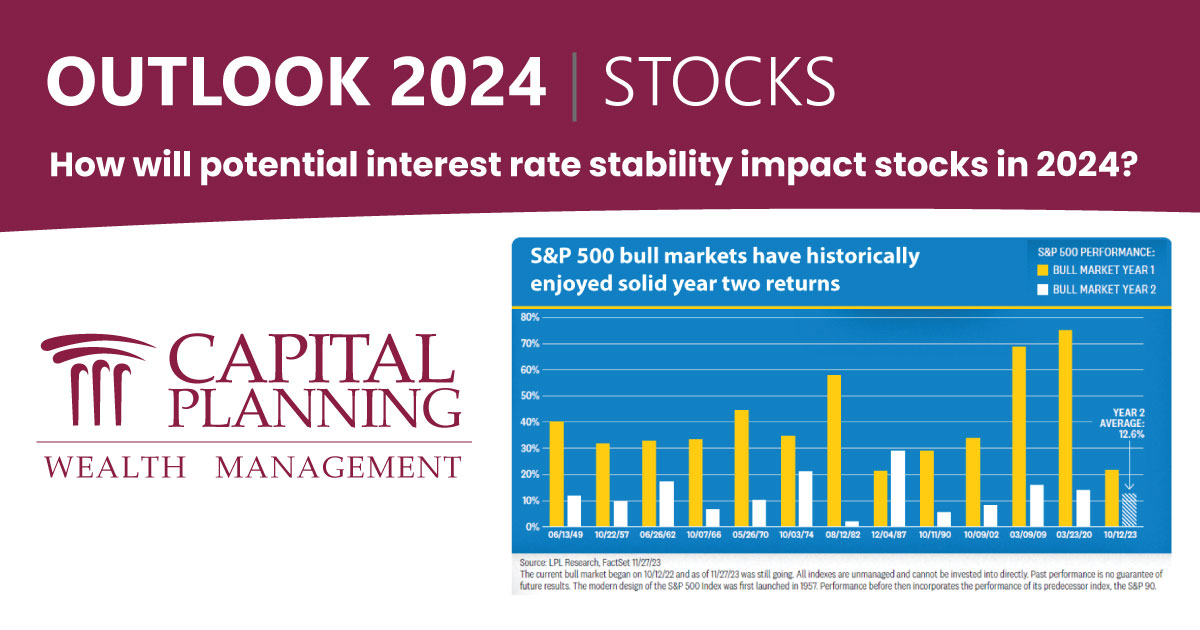

Following the Fed’s aggressive rate-hiking campaign to combat the massive inflation surge, the stock market will become one where participants are focused on interest rate stability. We expect inflation will come down further, and as it does, interest rate stabilization should help support stock valuations, just as some of the biggest headwinds for corporate America begin to reverse.ECONOMIC CYCLEThis one has been unique, to put it mildly given the highly uneven recovery in recent years coming out of the pandemic. As previously discussed, a mild, short-lived recession in 2024, followed by recovery later in the year is our basecase scenario. The uncertainty that comes with anticipating a recession may limit stock gains as 2024 begins. But it could bolster investor sentiment midyear, as is typical coming out of an economic trough (the lowest part and turning point of an economic cycle). Keep in mind, the market’s reaction to the economic cycle in 2024 could be muted, given that stocks essentially priced in a recession in 2022 following the surge in growth of the postpandemic economy.BULL MARKET CYCLEThe young age of this bull market historically points to solid gains ahead. The start of the current bull market (began in Oct 2022)…

The economy grew faster than expected in recent quarters, unemployment remained historically low, and activity in some sectors grew (e.g., homebuilding), despite the macro headwinds. The labor market seemed to be a boon for workers in prime positions to bargain for better pay and more benefits. In 2024, we believe a recession is likely to emerge as consumers buckle under debt burdens and use up their excess savings, but a Fed that is sensitive to risk management might provide an offset by taking interest rates down again in the new year. Inflation may remain a concern, but the Fed will likely be less laser-focused given the trajectory is going in the right direction. In sum, we expect a mild recession to occur in 2024, although that may usher in some interest rate decreases from the Fed and offset some of the economic and market impact.Turning points are often marked by a series of significant events, but it’s also valuable to put those events in context. For the U.S. economy, the event that might accompany this time of change could be a recession. However, if we look back on the post-pandemic economy, many things have gone better than expected.THE RECESSION CALL…

Just as we saw in 2023, the IRS has announced some adjustments to contribution limits as we head into the new year. Starting January 1, 2024, the annual contribution limits for several popular retirement savings plans will be increasing. This presents an excellent opportunity for you to save more towards your retirement goals.Here is a breakdown of the key updates:401(k), 403(b) and Most 457 Plans:The annual elective deferral limit increases by $500, from $22,500 in 2023 to $23,000 in 2024.Traditional and Roth IRAs:The annual contribution limit increases by $500, from $6,500 in 2023 to $7,000 in 2024. This applies to both traditional and Roth IRAs, allowing you to save even more for retirement.The IRA catch-up contribution limit for people aged 50 and over remains $1,000 for 2024. Catch-up limits allow older plan participants to put away more money, since they have less time to save.SIMPLE IRAs:The amount individuals can contribute is increased from $15,500 in 2023 to $16,000 in 2024.SEP-IRA and Profit Sharing:The annual contribution limit increases from $66,000 in 2023 to $69,000 in 2024.Why are these changes important?These increases in contribution limits allow you to save more money for your future and potentially achieve your retirement goals faster. We encourage you to review your…

Planning for an unpredictable future can feel overwhelming, with so many decisions to make it can be hard to know if you're going to have enough money to support yourself through retirement.

In this guide, experts from the Capital Planning Team have simplified the 10 steps you can take, so that you can live a life without worry, sfe in the knowledge that your financial future is secure.